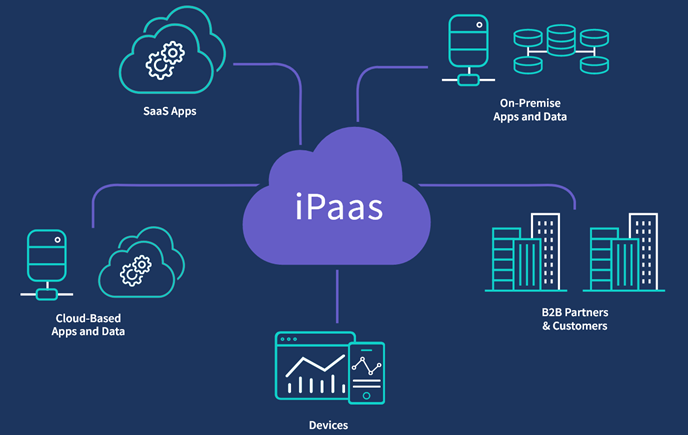

A comprehensive Integration Platform as a Service Industry Analysis reveals a dynamic and highly competitive industry that has evolved from a niche middleware category to a central pillar of the modern enterprise IT stack. The industry's structure is defined by a fascinating interplay between several distinct categories of players. The first group consists of the pure-play, cloud-native iPaaS vendors who pioneered the market. Companies like Boomi (now independent after being owned by Dell) and MuleSoft (acquired by Salesforce) were the early visionaries who recognized the impending "SaaS explosion" and built platforms specifically designed to solve the cloud integration challenge. Their offerings are characterized by a large library of pre-built connectors, a low-code graphical interface for building integration flows, and a focus on serving the needs of both IT professionals and less-technical "citizen integrators." They are the specialists who have built their entire business around the art and science of integration.

The second major group of players are the major public cloud providers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Each of these hyperscalers has developed its own suite of native integration services as a core part of its cloud platform. Services like AWS Step Functions, Azure Logic Apps, and Google Cloud's Application Integration are designed to make it incredibly easy for developers to connect and orchestrate the various other services within that specific cloud provider's ecosystem. Their competitive advantage is deep, seamless integration with their own platform and a consumption-based pricing model that is attractive to their millions of existing cloud customers. They are not necessarily trying to be the best solution for connecting to external SaaS apps, but they are a powerful and often default choice for any integration tasks that are internal to their own cloud environment. This creates a significant competitive pressure on the pure-play vendors.

A third, and equally important, group consists of the major enterprise software and SaaS vendors who have either built or acquired their own iPaaS capabilities to better serve their customers. Salesforce's acquisition of MuleSoft is the landmark example. The strategic logic is that a major application platform needs a powerful integration capability to be a true "hub" for its customers' data. By owning a leading iPaaS platform, a SaaS vendor can make it much easier for customers to connect their core application to the hundreds of other apps in their ecosystem, which dramatically increases the stickiness and strategic value of their core platform. Similarly, major ERP vendors like SAP and Oracle have also built out their own integration platforms to help their customers connect their legacy on-premise systems to the cloud. This trend of major application vendors becoming major integration vendors is a key theme of the industry's evolution, blurring the lines between an application platform and an integration platform. The Integration Platform as a Service Market size is projected to grow to USD 211.36 Billion by 2035, exhibiting a CAGR of 28.87% during the forecast period 2025-2035.

Top Trending Reports -